There are 3 common methods used to value real estate in Japan. Depending on the type of property you are considering purchasing, you may wish to use one or more methods of valuation.

There are several major characteristics which can impact the value of properties in Japan, such as the distance from the nearest train station, the size of the land and building, the age of the structure and proximity to schools, parks, and shopping. Other features, such as the quality of common facilities in the case of multi-unit apartments, earthquake resistance, balcony size and orientation of building should be considered during the evaluation process.

Below are the 3 main approaches used to value properties in Japan:

| Method Name | Key Facture | Type of Real Estate Applied to: |

| 1.Cost Approach

原価法 |

Calculate the estimated replacement cost for constructing a new property of the same type, then discounting from there based on the building age and current condition. | Land, Houses, Investment Property, etc. |

| 2.Market Approach

取引事例比較法 |

Calculate the price based on the similar sales samples. | Apartment, Land, House, Investment Property and others |

| 3.Income Approach

収益還元法 |

Calculate the price by estimating how much income this property can generate in the future. | Mainly for Investment Property |

Real Estate Transaction Price Information

Real Estate Companies can check recent and historical sales data and other market information using the real estate information network (Reins). If there are many listings but not many sold properties in a certain area, this is considered as high supply area. If there are many sold properties with few listings, this area is considered as a high demand area.

The Ministry of Land, Infrastructure, Transportation and Tourism (MLIT) maintains a website that shows transaction records. (Smaller sample size than Reins) Anyone can view this site. You can select the area to see the transactional information.

Japanese: http://www.land.mlit.go.jp/webland/servlet/MainServlet

English: http://www.land.mlit.go.jp/webland_english/servlet/MainServlet

1) Cost Approach

This approach is mainly used for Houses, Land and Investment Properties.

The appraised value is derived from the cost approach is called Sekisan Kakaku. (積算価格)

Building Price=

Price per sqm × Building Area (sqm) ×(Useful Life -Building Age)/ Useful Life

Land Price = Price per sqm×Land Area (sqm)

Appraised Value (Sekisan Kakaku) = Market Value (Building Price + Land Price)

Case 1

Building Price Calculation Sample

Building: Total Floor Area 120sqm, 10-year old wood structure

Building Price=

152,100 yen per sqm × 120 sqm ×(22 years-10 years)/ 22 years=9,954,640 yen

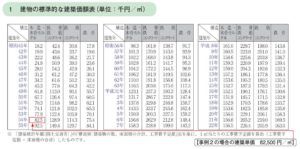

Using the building price list for 2016, a 10-year old wooden structure is will cost 152,100 yen per sqm. A wooden structure’s useful life is calculated at 22 years.

To calculate the price per sqm you can use the building price list from The National Tax Agency 2016

Building Age —-use Building Age List from National Tax Agency.

Land Price Calculation Sample

Land: Land Size 200 sqm, street price 200,000 yen per sqm

Land Price = 200,000 yen per sqm ÷0.8 × 200 sqm = 50,000,000 yen

The street price is 80% of the market price. In order to get the market price, we divide the street price by 0.8 or get the land price by sold information.

Street Price (Rosenka路線価)—- Street Price by National Tax Agency

Appraised Value (Sekisan Kakaku) =

Market Value (Building Price 9,954,640 yen + Land Price 50,000,000 yen)

=59,954,640 yen

Case 2 – Investment Property

Building Price=

Replacement Cost per sqm × Building Area (sqm) ×(Service Life -Building Age)/ Service Life

Land Price = Price per sqm×Land Area (sqm)

Appraised Value (Sekisan Kakaku) = Market Value (Building Price + Land Price)

Building Price Calculation Sample

Building: Total Floor Area 120sqm, 10-year old wooden structure

Building Price=

150,000 yen per sqm × 120 sqm ×(22 years-10 years)/ 22 years=9,819,000 yen

Estimated Replacement Costs by Building Material:

Reinforced Concrete Structure (RC) —– 200,000 yen per sqm

Steel Structure ——————————— 180,000 yen per sqm

Wood Structure ——————————- 150,000 yen per sqm

Light Steel Structure ———————— 130,000 yen to 150,000 yen per sqm

Land Price Calculation Sample

Land: Land Size 200 sqm, Street Price 200,000 yen per sqm

Land Price = 200,000 yen per sqm × 200 sqm = 40,000,000 yen

Appraised Value (Sekisan Kakaku) =

Market Value (Building Price 9,819,000 yen + Land Price 40,000,000 yen)

=49,818,000 yen

2) Market Approach

This approach is mainly used for apartments.

The appraised value is derived from a market approach is called Hijyun Kakaku. (比準価格)

Appraised Value (Hijyun Kakaku) =

Market Value (Average Price per sqm from similar sale samples ×Area)

Asses the average price per sqm of units in the same building, or similar properties nearby. Looking at a number of similar properties is the key to accurately estimate the average price.

3) Income Approach

This approach is mainly used for investment properties.

An appraisal derived from the income approach is called Syueki Kakaku. (収益価格)

Appraised Value (Syueki Kakaku) = Net Operating Income÷Capitalization Rate

Rent income minus expenses is Net Operating Income.

Calculation Example

Whole Building Apartment, 10 years old, RC Structure

Annual Rent Income 10,800,000 yen

Annual Expense 1,800,000 yen

>>>From the age of building, structure, and area. Assume Capitalization Rate as 8%.

Appraised Value (Syueki Kakaku) =

{ (10,800,000 yen -1,800,000 yen)÷8%}= 112,500,000 yen

The problem with using this approach is that land size, building size and other factors except income are not taken into consideration. For example, an apartment on 100sqm of land and an apartment on 300sqm of land could have the same income, so the appraised value would be the same. Therefore, we would recommend caution when only using this approach.

At Solid Real Estate, when assisting clients that wish to purchase investment property using a bank loan, we emphasize the importance of the lending institution’s collateral evaluation. If this collateral evaluation is low, the client’s down payment will become higher. Also, if this evaluation is high, it is may be easy to sell the property in the future, because a future buyer should also be able to secure financing as well. Most of the major lenders use a combination of Cost Approach and Income Approach when evaluating investment properties.